In this exhaustive article, we will guide you through the fundamental components of Indian GST (Goods and Services Tax) fulfilment. We will also give practical insights into how businesses can effectively navigate and streamline their procedures to ensure compliance. Additionally, we will discuss the advantages of e-invoicing for GST compliance, how to use it effectively, as well as the advantages of GST e-way bills. We will also cover the process of generating and managing e-way bills, collecting invoices, credit notes, debit notes, and Input Tax Credit with a timely claiming method, Input Tax Credit (ITC), correct GST itc claims, GST payments and returns filed on time, payment of tax, GST return filing, GST annual return and reconciliation, GST Annual return filing. We will also provide information on correct ITC claims and ensuring that returns are filed on time.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

| Tags |

|---|

Your new post is loading... Your new post is loading...

Your new post is loading... Your new post is loading...

From

bcrelx

The Compliance portal, located on the Tax Department website, is intended to assist taxpayers in making sure that their Income Tax Returns (ITRs) are accurately completed and that they are complying with all applicable tax rules and regulations. This site, which is easily available to taxpayers at any time, provides extensive information that makes it easier for them to identify and correct any inconsistencies in their online returns. Certain instances of disparities found in the ITRs filed for the Assessment Year 2021–22 (Financial Year 2020–21) have recently come to the attention of the Income Tax Department. Official declarations state that differences, referred to as "mismatches," have been observed between the information contained in tax returns and the department's records pertaining to financial transactions.

For both individuals and corporations, navigating the complicated tax landscape may be a difficult undertaking. However, this process can be made much simpler with the assistance of tax experts. To guarantee that their clients continue to comply with tax rules and regulations, tax specialists provide invaluable counsel. Tax professionals who want to succeed in this industry must have access to cutting-edge tools that make their work easier. Gen Income Tax Software is one such product that has completely changed how tax professionals do their work. This article explores the critical role that this software plays in optimising the workflows of tax professionals and raising the standard of their services.

From

techiesbuzz

There are two different sections of 80DD and 80DDB of the I-T Act that provide income tax deductions for medical expenses. They vary with the maximum tax deduction amount that can be claimed. Under section 80DDB I-T act, normal patients and senior citizens can claim a maximum I-T deduction amount of INR 40K and INR 1 lakh, separately. Section 80DD gives a higher tax deduction for the amount of normal disability INR 75K and INR 1.25 lakh for severe disability. To claim the tax deductions related to inability, you have a valid certificate of disability issued by medical authorities. This article will explain the types of saving methods of I-T other than tax deduction 80C for AY 24-25.

The Goods and Services Tax (GST) registration certificate is a crucial legal document for businesses and taxpayers operating in India. It is mandatory for businesses with an annual turnover of over Rs. 40 lakh, or Rs. 20 lakh for special category states, to register for GST. The turnover threshold for GST registration was previously Rs. 20 lakh and Rs. 10 lakh for special category states. GST registration is not only essential for businesses and enterprises, but also for common taxpayers, non-resident taxable persons, and others who exceed the mentioned turnover limits. This article offers comprehensive insights into GST registration, covering everything from its definition to the registration process and associated benefits to help you navigate the registration process with ease.

From

swengen

ITR (income tax return) filing is almost over, and it can be a difficult process, especially for those filing for the first time. Many people have trouble completing their ITR because they don't understand the basic principles. This misunderstanding might make things more difficult and ultimately confusing. Therefore, before completing the ITR, it is imperative to have a thorough grasp of taxable income and the many tax regimes accessible. Possessing this knowledge will enable you to file your ITR correctly and without error.

It's easy to comprehend senior citizenship in India. The law defines a senior citizen in India as any citizen who is 60 years of age or older; this definition replaces the previous one, which was 65 years. Various age requirements used to apply for different things, such as airline and train tickets, but they are now all fixed at 60 years old. A person who is 60 years of age or older on the last day of the fiscal year is considered a senior citizen, as defined by the Income Tax Act.

In this post, we will present additional information on income tax deductions that are available when submitting income tax returns. These deductions assist individuals in reducing their taxable income, lowering their overall tax bill for the fiscal year. Tax deductions are investments made during the fiscal year that offset gross yearly income when filing an ITR, whether online or offline, as stipulated by the CBDT department.

From

www

A Limited Liability Partnership (LLP) combines the benefits of partnerships and corporations, giving professionals significant advantages. We have explained simple and quick steps to incorporate LLP registration, as well as the benefits of doing so, such as restricted liability, flexibility, and simpler compliance. In this extensive tutorial, we look at the benefits of LLP registration and present a step-by-step incorporation process.

Filing an ITR by taxpayers is a very crucial process. In this article, we will discuss the multiple processes of filing an ITR, their eligibility criteria, their advantages, and the step-by-step process of filing returns both online and offline methods. Further, we also discuss the process of verification, e-filing, and validating the submitted return. E-filing refers to the process of electronically furnishing an ITR through the Internet. We hope that this guide will easily help you to e-file your tax returns in a hassle-free manner and make the process smoother for you.

The balance sheet provides a complete summary of the assets liabilities, and equity of a company. The report takes a snapshot of the financial status of a firm at one point in time, usually prepared by an accounting professional at the end of the month and quarter, or the end of the year. Among the components of a balance sheet are the assets, liabilities, and net worth of the business. As a company's assets should equal its liabilities plus equity, the term balance sheet reflects this principle. We will discuss the essential components of balance sheets, their advantages, disadvantages, and practical examples in this article.

Understanding Tax Deducted at Source (TDS) on Rent in India is covered under Section 194-I of the Income Tax Act. This rule requires both individuals and corporations to deduct TDS from rental payments. We also discuss penalties, interest rates, and the application of TDS on rent. Here's a rundown of the possible implications of non-compliance, which include TDS challan-cum-statement (Form 26QC), tax penalties under Section 271-H, late fines under Section 234-E, and more. To avoid such penalties, individuals and businesses must follow state schedules and requirements for filing TDS and TCS taxes.

Filing taxes online can be complicated because there are lots of rules and regulations. Many individuals are not ready with all the records which they need, and doing the math can be complex. The government has multiple taxes like income tax, service tax, TDS, and wealth tax. So, if you have to file many taxes at once, you need special software to help. Genius is one of those software made by SAG Infotech. It's for CA, CS and professionals. They made it after doing a lot of research. In this article, we talk about six parts of Genius software with its important features. |

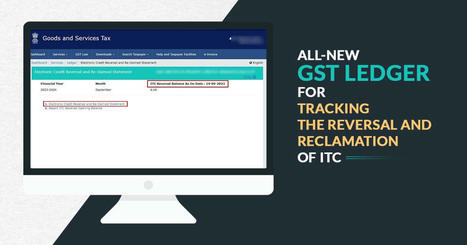

Learn about the new GST portal ledger, Electronic Credit Reversal and Reclaimed Statement (ECRRS), and the key measures for ITC reclaim. Know the GST portal's new ledger called Electronic Credit Reversal and Reclaimed Statement (ECRRS). Also, we mention the ITC reclaim key measures, etc.

The Income Tax Department has made the process of filing Income Tax Returns (ITR) simpler and more efficient for taxpayers in the fiscal year 2023-24 (AY25). To achieve this, the department has introduced three new online forms, namely ITR-1, ITR-2, and ITR-4. These forms can be accessed easily on the department's official website, making it convenient for individuals across the country to file their tax returns. The introduction of these new forms aims to simplify and expedite the tax filing process for taxpayers. The online forms have been available since April 1, 2024, offering taxpayers ample time to complete and file their returns.

Welcome to our information page about TDS (Tax Deducted at Source). This is where you can locate a wide range of news stories and articles that offer in-depth analysis of the tax system. The income tax agency enforces the statutory TDS tax deduction procedure. Understanding whether goods and services are subject to taxes as well as where the deduction of taxes is required is crucial. You can anticipate hearing from the Taxation Council as a taxpayer about any adjustments to TDS or changes to the deduction rates. For all of your information needs pertaining to TDS, our portal is a one-stop shop. In order to facilitate your navigation of the intricate tax system, we strive to keep you informed about the most recent advancements in the TDS system.

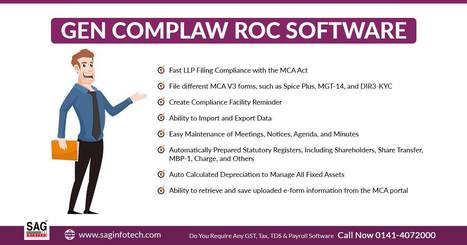

An all-in-one solution that makes submitting MCA V3 e-Forms, XBRL, Resolutions, Minutes, Registers, and MIS reports easier is the cutting-edge Gen CompLaw ROC Software. This state-of-the-art technology is intended to assist companies in streamlining their operations and guaranteeing quick and correct XBRL E-Filings, all while adhering to the Companies Act, 2013's legal requirements. This software is different from others in that it has an easy-to-use interface and responds quickly, making it a useful tool for handling important tasks. Gen CompLaw ROC Software is the best option for companies wishing to improve their filing procedure because of its sophisticated capabilities.

For Indian taxpayers, filing an Income Tax Return (ITR) is an essential process that entails disclosing their income and paying taxes to the income tax department. The Income Tax Act of 1961 rigorously governs the ITR forms and procedures. ITR-2 is one of the available forms that is primarily meant for individuals and Hindu Undivided Families who do not receive any income from company or professional endeavours. Gen IT Software offers an effective solution that meets all of your tax filing requirements, facilitating the ITR-2 filing procedure. Our team of professionals helps you every step of the way and makes sure you comply with all tax regulations. You can manage the complexity of tax submission with ease if you use Gen Income Tax Software ITR-2 Filing Services. You can feel relieved and at ease as our experts handle your tax return responsibilities, freeing you up to concentrate on other important duties.

The Goods and Services Tax (GST) decisions made in 2023 were crucial in determining how taxes are imposed in India. Here, we've highlighted five notable GST rulings that made a big difference. Input tax credit matching, hostel GST rates, registration cancellations, and other important cases are covered in detail on this page. In one such instance, the Rajasthan High Court resolved Hindustan Unilever's input tax credit concerns. Hindustan Unilever Ltd.'s complaints about the lack of a system to reconcile supplier credit notes with input tax credit reversals were taken up by the court.

From

www

When is the tax advance due? According to section 208 of the Income Tax Act, of 1961, advance tax must be paid during the financial year in which the tax liability is INR 10,000 or more. Who has to pay the advance tax? If any of the following circumstances are true, an individual who resides in India is exempt from the advance tax provisions: The person does not have any income falling under the heading of "Profits and Gains from Business or Profession," and the person was 60 years of age or older at any point in the prior year.

Amit Gupta's insight:

Share your insight

Gen TDS is a popular and well-regarded e-filing software that has built its reputation on continuous performance. It ranks first on the Indian government's authorised list of software for fiscal year 2012-2013. SAG Infotech's Gen TDS software stands out for its comprehensive TDS return filing features. With its user-friendly interface, taxpayers may easily file TCS and TDS returns that comply with CPC and TRACES laws in India.

SAG Infotech Pvt Ltd. is a reputable and dependable taxation software provider headquartered in Jaipur. With over 20 years of experience in tax software and challan payments for various entities, it has become a household name, trusted by over 60,000 clients and businesses across the country.

From

midnu

Tax collection by the government has included two primary methods such as direct and indirect tax, which apply to persons and businesses. TDS pertains to tax deductions made from different income sources such as salary, fixed deposits, and recurring deposits. Essentially, companies deduct a portion of their employee's income and submit it to the government, streamlining tax collection effectively. Both TDS and TCS operate as income sources, yet they serve distinct purposes and have different applications. While TDS involves deducting tax from various income streams such as salaries, rent, and commissions, TCS operates similarly but with its specific domain. Here, we outline the benefits of using Gen TDS software for businesses.

It's tax season again! In India, the months of June and July highlight the yearly financial ritual in which citizens must submit their income tax returns for the preceding fiscal year by July 31st. For the fiscal year 2016-17, which runs from April 1, 2016 to March 31, 2017, the e-filing deadline for income tax returns is July 31, 2017. Filing income tax returns is a mandatory requirement for Indian nationals. Individuals with a yearly income of up to ₹2.5 lakh are exempt from tax. However, it is recommended to file reports even if your income is below the taxable threshold for compliance concerns. Tax returns are required documents when applying for loans or visas. Furthermore, e-filing is required for claims.

From

bbuspost

The Income Tax Return (ITR) filing deadline is rapidly approaching, so it's important to raise awareness about the risks associated with rushing through essential income-related information. Since the deadline is looming, tax experts warn against any last-minute delays. One such challenge is the possibility of discrepancies between the AIS, Form 26AS, and 16. Many taxpayers encounter problems reconciling these documents during the process of ITR filing, leading to potential delays. In this discussion, we'll explore what steps should we take when facing TDS mismatches in forms 26AS, AIS, and 16. |