Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

| Tags |

|---|

Your new post is loading... Your new post is loading...

Your new post is loading... Your new post is loading...

In this post, we will discuss the career gap, why it is okay to have one, and how to deal with it when looking for a Chartered Accountant (CA) job. We have listed tips for handling a career gap when applying for a CA job, including explaining the causes, being genuine and cheerful, showcasing activities done during the gap, highlighting preparedness, correlating skills to the job, emphasizing value, focusing on achievements, enhancing skills, and avoiding common mistakes during a CA job interview after a career gap. Some of the mistakes to avoid include sharing too much information, ignoring the gap, accusing others, being dishonest, using general explanations, failing to remain updated, underestimating the value of volunteer freelance projects or work, lacking trust, and failing to demonstrate personal and professional growth, and neglecting networking.

SAG Infotech is a taxation-based company that specialises in tax software for accountants and tax professionals in India. Their products mainly have different forms such as Genius, Gen Payroll, Online Gen GST, Gen ROC and XBRL which are cost-effective and cater to the needs of the accounting and finance industries. The company works with the latest rules, regulations and different technology to provide the best IT solutions for their clients.

In this post, we have covered the basic information on income tax forms 60 and 61 used for reporting income in India. We have also discussed their benefits and drawbacks. These forms serve a specific purpose in financial transactions. For instance, Form 60 is used when an individual carries out transactions that require a Permanent Account Number (PAN) but they don't have one. It verifies their identification and location.

From

www

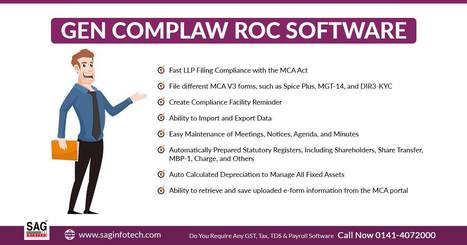

Gen CompLaw Software offers an innovative solution, simplifying company compliance with essential MIS reports such as XBRL, Resolutions, Minutes, and Registers. It facilitates the submission of MCA version 3 e-forms, eliminating technical obstacles. With its user-friendly interface, this software enables seamless completion of compliance tasks for all users.

In the labyrinth of business rules and administrative processes, the Corporate Identification Number (CIN) emerges as a beacon of clarity for companies operating in India. Administered by the Registrar of Companies (ROC) and mandated by the MCA (Ministry of Corporate Affairs), the CIN serves as a distinctive fingerprint for every registered firm, facilitating transparency, accountability, and regulatory compliance. In this article, we embark on a journey to unravel the essence of Corporate Identification Number, its significance, and practical insights into its verification process.

In this exhaustive article, we will guide you through the fundamental components of Indian GST (Goods and Services Tax) fulfilment. We will also give practical insights into how businesses can effectively navigate and streamline their procedures to ensure compliance. Additionally, we will discuss the advantages of e-invoicing for GST compliance, how to use it effectively, as well as the advantages of GST e-way bills. We will also cover the process of generating and managing e-way bills, collecting invoices, credit notes, debit notes, and Input Tax Credit with a timely claiming method, Input Tax Credit (ITC), correct GST itc claims, GST payments and returns filed on time, payment of tax, GST return filing, GST annual return and reconciliation, GST Annual return filing. We will also provide information on correct ITC claims and ensuring that returns are filed on time.

From

bcrelx

The Compliance portal, located on the Tax Department website, is intended to assist taxpayers in making sure that their Income Tax Returns (ITRs) are accurately completed and that they are complying with all applicable tax rules and regulations. This site, which is easily available to taxpayers at any time, provides extensive information that makes it easier for them to identify and correct any inconsistencies in their online returns. Certain instances of disparities found in the ITRs filed for the Assessment Year 2021–22 (Financial Year 2020–21) have recently come to the attention of the Income Tax Department. Official declarations state that differences, referred to as "mismatches," have been observed between the information contained in tax returns and the department's records pertaining to financial transactions.

For both individuals and corporations, navigating the complicated tax landscape may be a difficult undertaking. However, this process can be made much simpler with the assistance of tax experts. To guarantee that their clients continue to comply with tax rules and regulations, tax specialists provide invaluable counsel. Tax professionals who want to succeed in this industry must have access to cutting-edge tools that make their work easier. Gen Income Tax Software is one such product that has completely changed how tax professionals do their work. This article explores the critical role that this software plays in optimising the workflows of tax professionals and raising the standard of their services.

From

techiesbuzz

There are two different sections of 80DD and 80DDB of the I-T Act that provide income tax deductions for medical expenses. They vary with the maximum tax deduction amount that can be claimed. Under section 80DDB I-T act, normal patients and senior citizens can claim a maximum I-T deduction amount of INR 40K and INR 1 lakh, separately. Section 80DD gives a higher tax deduction for the amount of normal disability INR 75K and INR 1.25 lakh for severe disability. To claim the tax deductions related to inability, you have a valid certificate of disability issued by medical authorities. This article will explain the types of saving methods of I-T other than tax deduction 80C for AY 24-25.

The Goods and Services Tax (GST) registration certificate is a crucial legal document for businesses and taxpayers operating in India. It is mandatory for businesses with an annual turnover of over Rs. 40 lakh, or Rs. 20 lakh for special category states, to register for GST. The turnover threshold for GST registration was previously Rs. 20 lakh and Rs. 10 lakh for special category states. GST registration is not only essential for businesses and enterprises, but also for common taxpayers, non-resident taxable persons, and others who exceed the mentioned turnover limits. This article offers comprehensive insights into GST registration, covering everything from its definition to the registration process and associated benefits to help you navigate the registration process with ease.

From

swengen

ITR (income tax return) filing is almost over, and it can be a difficult process, especially for those filing for the first time. Many people have trouble completing their ITR because they don't understand the basic principles. This misunderstanding might make things more difficult and ultimately confusing. Therefore, before completing the ITR, it is imperative to have a thorough grasp of taxable income and the many tax regimes accessible. Possessing this knowledge will enable you to file your ITR correctly and without error.

It's easy to comprehend senior citizenship in India. The law defines a senior citizen in India as any citizen who is 60 years of age or older; this definition replaces the previous one, which was 65 years. Various age requirements used to apply for different things, such as airline and train tickets, but they are now all fixed at 60 years old. A person who is 60 years of age or older on the last day of the fiscal year is considered a senior citizen, as defined by the Income Tax Act.

In this post, we will present additional information on income tax deductions that are available when submitting income tax returns. These deductions assist individuals in reducing their taxable income, lowering their overall tax bill for the fiscal year. Tax deductions are investments made during the fiscal year that offset gross yearly income when filing an ITR, whether online or offline, as stipulated by the CBDT department. |

From

www

In India, Chartered Accountants, Company Secretaries, and tax experts frequently utilise the Gen Balance Sheet. The purpose of this software is to handle and expedite accounting tasks effectively. It makes it simple for users to create profit and loss statements and balance sheets for taxation. Gen BAL also makes tax calculations easier to understand and fills out different tax audit forms easier. Furthermore, sample balances from outside accounting programmes like Tally and Busy may be easily imported by users, saving time and lowering the possibility of mistakes.

SAG Infotech Genius software solution has become the most popular in India due to the filing of tax returns with different rules imposed by the government. The software has helped more than 25,000 clients to quickly file their taxes on time. The company has worked harder to support its clients in meeting all of their requirements and methods. The company offers multiple unique services, including instant ITR filing as soon as the client provides their details, a free trial of 10 active hours, and affordable prices.

From

www

SAG Infotech's Genius Tax program is one of the greatest tools which is mostly used by tax experts. This software helps save time, money, and taxes for individuals. This user-friendly software enables various tasks such as tax filing, GST management, and balance sheet creation. It stays updated with the latest tax regulations and rules, ensuring efficient management of financial tasks and continuous improvement through regular updates.

From

www

SAG Infotech's Gen Income Tax software, which is in high demand in India, was painstakingly designed to make submitting income tax returns online easier and more efficient. With the help of this outstanding software, tax professionals can accurately and efficiently file their customers' tax returns online thanks to a number of features. Users of Gen Income Tax can calculate arrear relief, create XML/JSON forms, import/export data, choose tax forms with ease, and even enable online e-payment challans. Because of its extensive features, Gen Income Tax has become a vital resource for tax experts throughout India.

Compliance as an LLP (Limited Liability Partnership) requires adherence to specific duties. Even though LLP laws are typically less onerous than those governing private limited businesses, it is nevertheless crucial to keep correct financial records and file papers on time. It is necessary to keep careful track of your financial documents, file income tax returns with the Income Tax department each year, and submit Form 11 to the Registrar of Companies (ROC) within 60 days of the financial year closing, which is usually around May 30.

Learn about the new GST portal ledger, Electronic Credit Reversal and Reclaimed Statement (ECRRS), and the key measures for ITC reclaim. Know the GST portal's new ledger called Electronic Credit Reversal and Reclaimed Statement (ECRRS). Also, we mention the ITC reclaim key measures, etc.

The Income Tax Department has made the process of filing Income Tax Returns (ITR) simpler and more efficient for taxpayers in the fiscal year 2023-24 (AY25). To achieve this, the department has introduced three new online forms, namely ITR-1, ITR-2, and ITR-4. These forms can be accessed easily on the department's official website, making it convenient for individuals across the country to file their tax returns. The introduction of these new forms aims to simplify and expedite the tax filing process for taxpayers. The online forms have been available since April 1, 2024, offering taxpayers ample time to complete and file their returns.

Welcome to our information page about TDS (Tax Deducted at Source). This is where you can locate a wide range of news stories and articles that offer in-depth analysis of the tax system. The income tax agency enforces the statutory TDS tax deduction procedure. Understanding whether goods and services are subject to taxes as well as where the deduction of taxes is required is crucial. You can anticipate hearing from the Taxation Council as a taxpayer about any adjustments to TDS or changes to the deduction rates. For all of your information needs pertaining to TDS, our portal is a one-stop shop. In order to facilitate your navigation of the intricate tax system, we strive to keep you informed about the most recent advancements in the TDS system.

An all-in-one solution that makes submitting MCA V3 e-Forms, XBRL, Resolutions, Minutes, Registers, and MIS reports easier is the cutting-edge Gen CompLaw ROC Software. This state-of-the-art technology is intended to assist companies in streamlining their operations and guaranteeing quick and correct XBRL E-Filings, all while adhering to the Companies Act, 2013's legal requirements. This software is different from others in that it has an easy-to-use interface and responds quickly, making it a useful tool for handling important tasks. Gen CompLaw ROC Software is the best option for companies wishing to improve their filing procedure because of its sophisticated capabilities.

For Indian taxpayers, filing an Income Tax Return (ITR) is an essential process that entails disclosing their income and paying taxes to the income tax department. The Income Tax Act of 1961 rigorously governs the ITR forms and procedures. ITR-2 is one of the available forms that is primarily meant for individuals and Hindu Undivided Families who do not receive any income from company or professional endeavours. Gen IT Software offers an effective solution that meets all of your tax filing requirements, facilitating the ITR-2 filing procedure. Our team of professionals helps you every step of the way and makes sure you comply with all tax regulations. You can manage the complexity of tax submission with ease if you use Gen Income Tax Software ITR-2 Filing Services. You can feel relieved and at ease as our experts handle your tax return responsibilities, freeing you up to concentrate on other important duties.

The Goods and Services Tax (GST) decisions made in 2023 were crucial in determining how taxes are imposed in India. Here, we've highlighted five notable GST rulings that made a big difference. Input tax credit matching, hostel GST rates, registration cancellations, and other important cases are covered in detail on this page. In one such instance, the Rajasthan High Court resolved Hindustan Unilever's input tax credit concerns. Hindustan Unilever Ltd.'s complaints about the lack of a system to reconcile supplier credit notes with input tax credit reversals were taken up by the court.

From

www

When is the tax advance due? According to section 208 of the Income Tax Act, of 1961, advance tax must be paid during the financial year in which the tax liability is INR 10,000 or more. Who has to pay the advance tax? If any of the following circumstances are true, an individual who resides in India is exempt from the advance tax provisions: The person does not have any income falling under the heading of "Profits and Gains from Business or Profession," and the person was 60 years of age or older at any point in the prior year.

Amit Gupta's insight:

Share your insight

|